Gifts that Pay you IncomeCharitable Remainder Trusts

-

Charitable Remainder UnitrustYou transfer your cash or appreciated property to fund a charitable remainder unitrust. The trust sells your property tax free and provides you with income for life or a term of years.

More -

Charitable Remainder Annuity TrustYou transfer your cash or appreciated property to fund a charitable remainder annuity trust. The trust sells your property tax free and provides you with fixed income for life or a term of years.

More -

Sale and UnitrustYou give a portion of your property to us to fund a charitable remainder trust, when the property sells you receive cash and income for life.

More -

Give It Twice TrustYou provide your children with a stream of income while making a gift to charity.

More -

Unitrust and Special Needs TrustIf you are looking for a way to provide for a loved one who has special needs, and also make a gift to the University of Indianapolis, a charitable remainder unitrust and a special needs trust arrangement could help you achieve your objectives.

More

Free Enewsletter

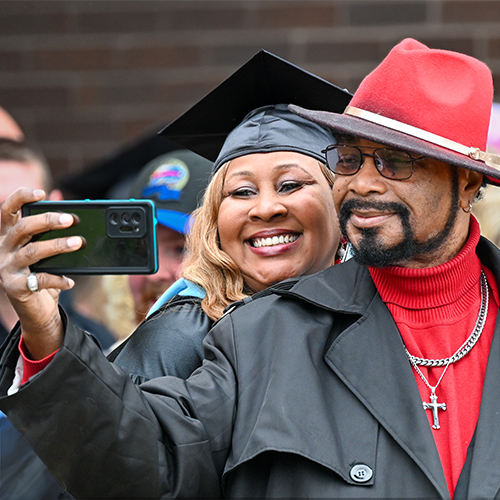

Subscribe to our weekly Enewsletter, featuring Washington news, finance information and donor stories.

Free Estate Planning Guide

Ready to plan your will or trust? Our free guide will provide you with helpful information to get you started.

Gift Calculators

Explore income and tax benefits for gifts that pay you during life.